Managing rental properties involves intricate financial tasks, from tracking income and expenses to managing tenant communications. As a landlord, choosing the right tool to manage these responsibilities is crucial for the efficiency and success of your business. This article dives into the debate between spreadsheets and dedicated rental property accounting software, exploring their advantages, drawbacks, and which might be the best fit for your needs.

The Role of Paperless Accounting Software in Property Management

In recent years, paperless accounting software has revolutionized how landlords manage their financials. These tools not only reduce the clutter of paperwork but also streamline processes like tracking rent payments and generating detailed financial reports. Transitioning to digital systems can lead to significant time savings and increased accuracy in your accounts, which is especially vital as your property portfolio grows.

Spreadsheets: A Customizable But Manual Option

Spreadsheets, like those offered by Google and Excel, are widely used in rental property accounting due to their customizability and simplicity. They allow landlords to tailor financial records precisely to their needs. This versatility makes them appealing for property owners who have specific or unique bookkeeping requirements.

- Customization: Crafting spreadsheets to suit your business needs means you can create specific data entries, visualizations, and analytics effortlessly.

- Simplicity: With an intuitive setup, spreadsheets offer an easy overview of your financial health without complex systems.

- Data visualization: Tools like pie charts and bar graphs can provide clear insights into your financial standings.

However, relying on spreadsheets entails manual data entry, which is time-consuming and prone to human error. This method also lacks the automated financial reporting capabilities available in the best rental property software, potentially complicating matters like tax preparation.

Best Rental Property Software: Automation and Accuracy

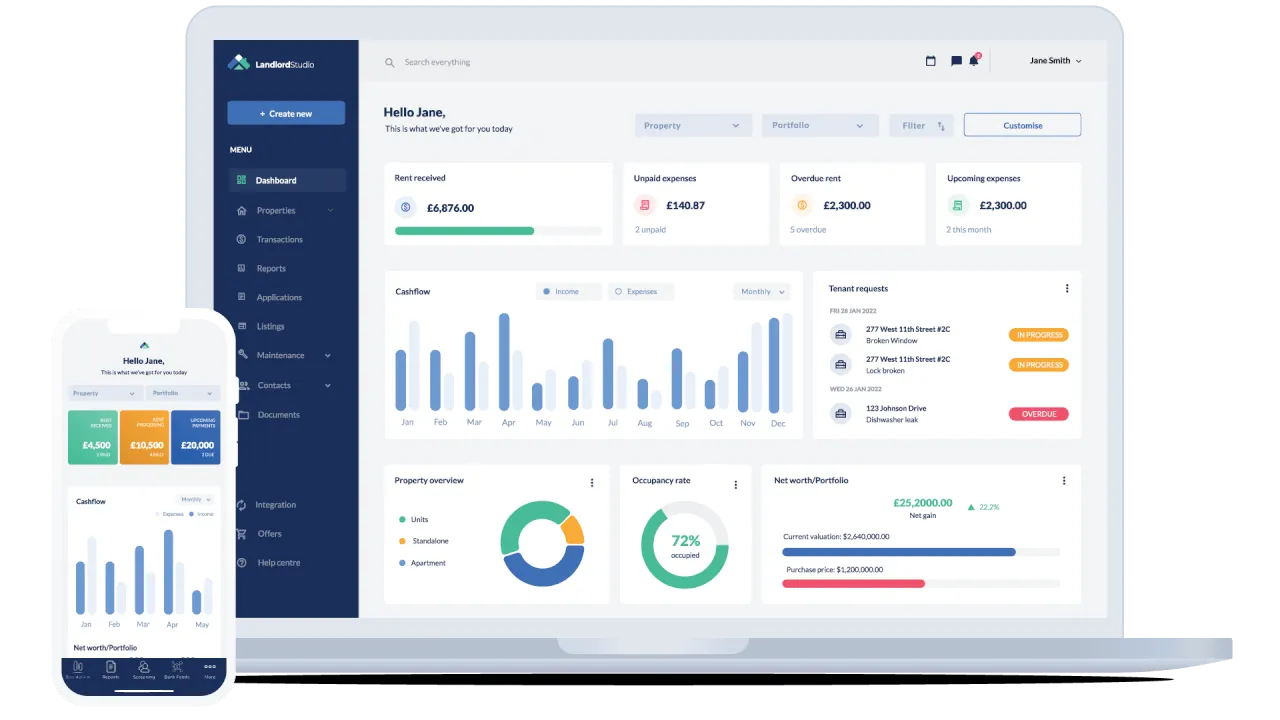

Rental property tracking software is a game-changer for landlords looking to streamline their financial management. These platforms are specifically designed to handle the complexities of real estate finance, integrating various functionalities that save time and effort.

- Accuracy: By automating data entry and consolidating records, rental accounting software minimizes errors, ensuring more reliable financial reporting.

- Advanced reporting: Automated reports on profits, losses, and asset schedules provide a comprehensive view of your financial situation, greatly easing tax season stress.

- Expense management: Predefined categories and cash flow tracking make handling expenses straightforward, enhancing your understanding of each property’s financial health.

- Integration capabilities: Connecting your bank accounts and property management systems allows transactions to sync seamlessly, encompassing rent payments, maintenance, and tenant communications.

Landlord accounting software, while requiring some initial investment, brings automation and efficiency that spreadsheets cannot match, especially for landlords with multiple properties or those seeking comprehensive financial oversight.

Weighing the Options: Which Method Suits You?

Deciding between spreadsheets and rental property accounting software ultimately depends on your specific needs, scale, and technical comfort level. For small-scale landlords managing few tenants, spreadsheets might suffice if cost and simplicity are priorities. However, as your rental business grows, software solutions can handle increased complexity and workload.

Spreadsheets may appeal to traditionalists or those looking for a low-cost solution, but their reliance on manual entry makes them less suitable for managing diverse, large-scale operations. Conversely, the best rental property software offers the automation, integration, and advanced features necessary for efficient, scalable property management.

The Future of Rental Property Management

As the real estate industry evolves, so do the tools designed to assist property owners. Adopting paperless accounting software can be a transformative step for landlords, offering not just operational efficiency but also enhanced financial clarity and control.

Whether you’re starting with a single unit or managing a large portfolio, choosing the right software can make all the difference. Evaluate your priorities and consider how automated, integrated solutions might support your business objectives. Ultimately, embracing the right technology today prepares you for the property management challenges of tomorrow.